Are You a Mental Millionaire or Bankrupt?

The surprising truth about your leadership potential

Imagine your mindset as a balance sheet — and no, I’m not talking about those dry, yawn-inducing pages that accountants love.

I’m talking about something far more critical: the ledger of your thoughts, beliefs, and attitudes.

It’s the real currency of leadership.

Now, if you’re thinking, “What in the world does a balance sheet have to do with my mindset?” hold onto your hats. You’re in for an enlightening ride, a bit like swapping your old bicycle for a Ferrari.

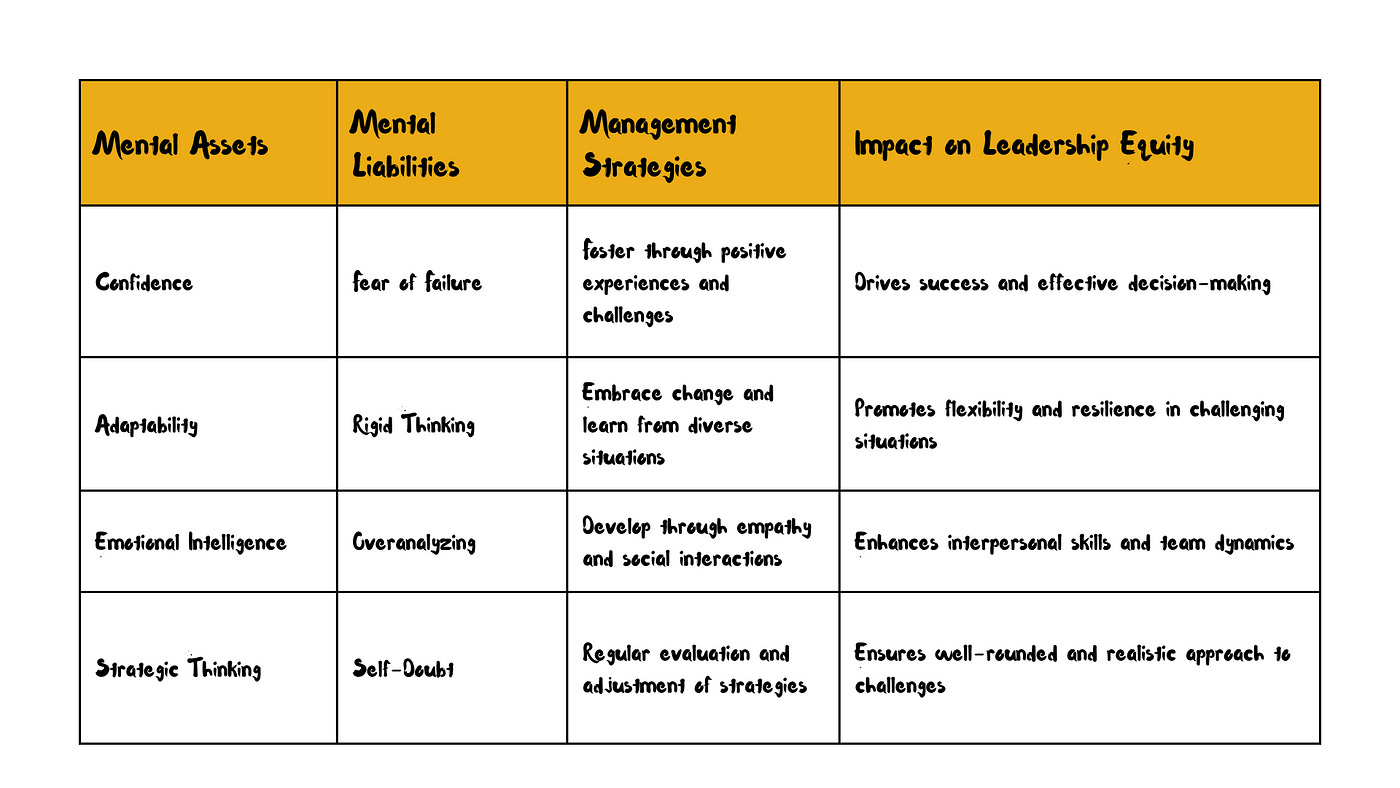

Let’s define this concept. A balance sheet, in the financial world, is a snapshot of a company’s financial health, showing assets, liabilities, and equity. Now, port this over to the realm of mindsets. Your mental assets are your positive beliefs and constructive thoughts, while your liabilities are those nagging, self-defeating ideas. Equity? That’s your overall mental resilience and attitude — the net result of your mental debits and credits.

Think about it.

On one side, you have assets like confidence, adaptability, and emotional intelligence. They’re like your cash reserves and high-value investments, driving you towards success.

Flip the page, and you encounter liabilities — fear, rigid thinking, a tendency to dwell on failures. These are your debts, the thoughts that drag you down and erode your leadership equity.

Let’s stir the pot.

Traditional thinking tells us to focus on beefing up our assets. “Be more confident,” they say, “develop your emotional intelligence.”

That’s great, but here’s where it gets juicy: What if I told you that managing your liabilities could be even more critical? That’s right, I’m flipping the script.

Consider a company with huge assets but even larger liabilities. It’s teetering on the brink of bankruptcy. Now apply this to your mindset. You can be as confident as a peacock, but if your fear of failure is sky-high, you’re like a skyscraper built on quicksand. Unstable, highly unstable.

Let’s roll with an analogy.

Picture two leaders.

Tom has a robust portfolio of mental assets—confidence, innovation, and empathy.

But Bob, while having fewer assets, has almost zero liabilities—minimal fear, hardly any rigid thinking.

Who’s more effective? Bob might just be the tortoise to Tom’s hare, steadily winning the race with a balanced sheet.

Now, this isn’t your cue to start a witch hunt for every negative thought. Let’s not go overboard.

It’s about strategic management. Minimize liabilities and maximize assets.

Think of it as mental judo—using self-awareness to flip your weaknesses into strengths.

But how, you ask? Well, it’s not with a wand-waving, fairy-tale solution. It involves gritty, roll-up-your-sleeves work. Start by auditing your mental balance sheet.

What are your assets? Maybe you’re a champ at strategic thinking. Great, keep investing there.

Now, the tough part — face those liabilities. Perhaps you have a habit of overanalyzing to the point of paralysis.

Acknowledge it. Then, strategize to reduce this liability, perhaps by setting strict time limits for decision-making.

Here’s where it gets controversial again. In our pursuit of ‘positive thinking’, we often overlook the power of intelligently managed negativity.

Yes, you heard that right. It’s like financial leverage.

A bit of debt can be a powerful tool if used wisely. Similarly, a touch of self-doubt can be your reality check, preventing overconfidence.

This balance sheet is dynamic. It changes with every new experience, every decision. Your job as a leader, creator, writer is to ensure that the equity — your mental resilience — is always in the black.

To wrap it up:

Developing a winning mindset isn’t just about accumulating mental assets; it’s about astutely managing your liabilities.

It’s about understanding that every thought, belief, and attitude is a line item impacting your leadership, creator, writer equity.

So, there you have it.

The balance sheet of a mindset.

It’s not just an accounting concept anymore.

It’s the core of your leadership, and your creativity.

Now, go ahead, take a hard look at your mental ledger.

What’s your balance?